THE LAW OF SCALE AND FRACTAL DIMENSION TO ADDUCE THE VALUES OF MUNICIPAL FISCAL MODULES— PARANÁ (BRAZIL)

DOI:

https://doi.org/10.5016/geografia.v47i1.16775Abstract

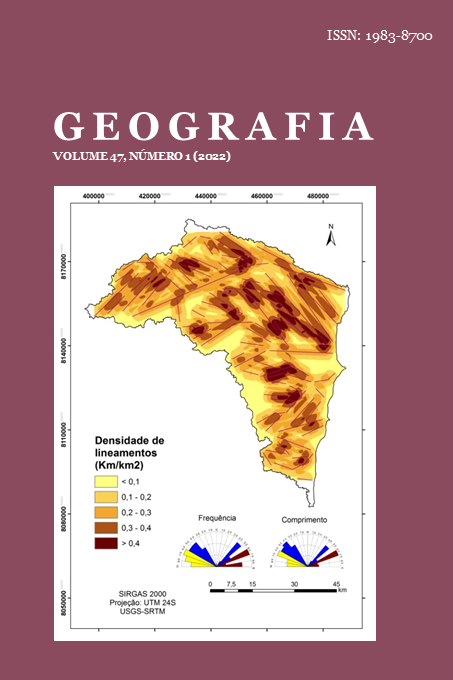

This study aims to evaluate the current method for calculating Rural Modules (RM) and Fiscal Modules (FM), and to propose a new calculation based on the law of scale and fractal dimension (of the municipalities). The study area was the state of Paraná, being the municipality of Centenário do Sul, with a 12-hectare FM, located in a region where all its bordering municipalities present FM values higher than 12 ha. The proposal seeks to simulate values to observe how the family farming properties are redistributed in the state, considering FM values with a 1.15 exponent. The current distribution shows that the number of family farming properties decreased by 8.7 in the municipality of Cascavel and increased by 17.5 in Centenário do Sul. However, the apparently negative impact in Cascavel shows a reduction of 24.5 in the area of family properties, indicating a concentration of area in a few properties.

Downloads

Published

Issue

Section

License

The authors maintain the copyright and grant GEOGRAFIA the right of first publication, with the articles simultaneously licensed under the Creative Commons BY 4.0 License, which allows sharing and adapting the articles for any purpose, as long as appropriate credits and provisions of image rights, privacy or moral rights. Other legal attributions can be accessed at: https://creativecommons.org/licenses/by/4.0/legalcode.en.

Geography, Rio Claro, SP, Brazil - eISSN 1983-8700 is licensed under the Creative Commons BY 4.0 License.